Financially Sound

Simple, swift access right from your phone. Only a single document needed to apply

Simple, swift access right from your phone. Only a single document needed to apply

A direct lender that values responsibility and innovation. We ensure your data's security and help in hard situations

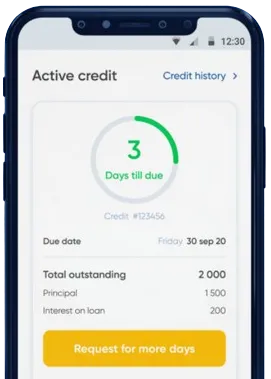

Quick and easy solutions right from your home. We transfer funds instantly and offer loan prolongation

Fill out an application form directly in our app.

Be on the lookout for our fast decision within 15 minutes.

Secure your funds, generally processed in just one minute.

Loan apps have revolutionized the way people in Kenya access credit. With the rise of digital lending platforms, it has become easier and faster for individuals to borrow money whenever they need it. In this article, we will discuss the benefits and usefulness of loan apps in Kenya.

One of the major benefits of loan apps in Kenya is the convenience and speed they offer. Traditional lending institutions such as banks may require a lot of paperwork and time for approval. However, loan apps enable borrowers to apply for a loan and receive funds within minutes. This is especially useful in emergencies when quick access to funds is essential.

Loan apps in Kenya offer flexibility in loan amounts, allowing borrowers to choose the amount they need based on their requirements. Whether it is a small amount for daily expenses or a larger sum for a major purchase, loan apps provide options for borrowers to tailor their loans to their specific needs.

Another advantage of loan apps in Kenya is that they are accessible to everyone, including individuals who may have had difficulties accessing credit from traditional sources. Loan apps do not require collateral or a good credit score, making them an inclusive option for those who may have been excluded from the traditional banking system.

Loan apps in Kenya also offer the convenience of repayment through mobile money platforms such as M-Pesa. This makes it easier for borrowers to repay their loans without the need to visit a physical location. The seamless integration with mobile money services simplifies the repayment process for borrowers, ensuring timely repayment and avoiding late fees.

In conclusion, loan apps in Kenya offer numerous benefits and are incredibly useful for individuals in need of quick and accessible credit. From the convenience and speed of approval to the flexibility in loan amounts and repayment options, loan apps provide a valuable financial tool for Kenyans. With the rise of digital lending platforms, loan apps have become an integral part of the financial landscape in Kenya, providing a lifeline for those in need of immediate funds.

Loan apps in Kenya are mobile applications that provide small, short-term loans to individuals in need of quick financial assistance.

Loan apps in Kenya typically require users to download the app, register, and provide personal information and banking details. Users can then apply for a loan within the app and receive funds directly into their bank account or mobile money wallet.

Requirements to qualify for a loan from loan apps in Kenya may vary, but generally include being a Kenyan citizen or resident, having a valid national ID, being over 18 years old, having a mobile phone, and a steady source of income.

The amount you can borrow from loan apps in Kenya varies depending on the app and your creditworthiness. Loan amounts typically range from as low as Ksh. 500 to as high as Ksh. 50,000 or more.

Interest rates for loans from loan apps in Kenya can be high, sometimes exceeding 15% per month. Repayment terms also vary, with some apps offering flexible terms while others require repayment within a short period, such as 30 days.

If you are unable to repay your loan from a loan app in Kenya, you may incur additional fees and interest charges. Some apps may also report non-payment to credit bureaus, which can negatively impact your credit score and future borrowing opportunities.